I know a lot of tea shop owners who are curious to read the following. But it should be beneficial if you’re in the process of setting up your store.

What will this article cover?

- The turnover of a retail store,

- Its expenses, including the compensation of the manager, the employee and the owner.

Let’s get started.

Table of contents

ToggleThis won’t be your store… it’s an example

What I think will help you is to give a realistic example based on the following assumptions:

- The shop is located in a medium-sized city (100.000 to 300.000 inhabitants) in Western Europe,

- Not located in the best shopping street, but not off-center either,

- Employs its owner/manager + one full-time employee,

- Size of premises: approx. 70m2 with a rent of 1,900€ / month.

Don’t think to yourself when you see these figures “it’s like that for all stores”. It’s not.

- Your store is in Paris, London, or Munich? Your turnover will be different.

- Do you have tough competition 10 meters away? Different sales.

- You own the business but don’t work there? You’ll also need an extra employee. And it’s going to impact your bottom line and the way you earn money will be different.

In short, there’s no single model…

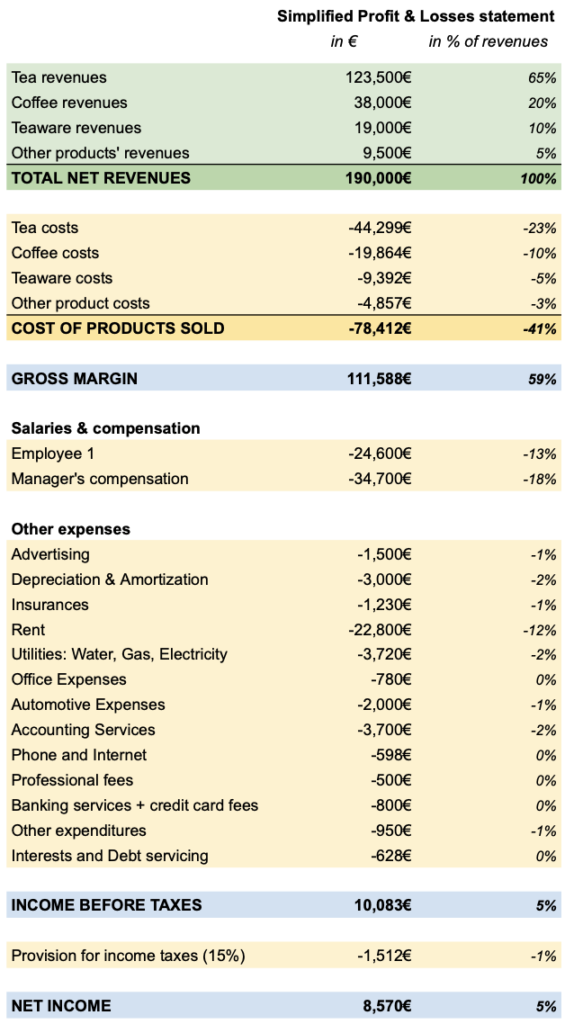

The income statement of a tea store

Okay, here’s what it looks like over a year:

Note: All amounts are before taxes.

My idea in this article is to explain where these figures come from and how to interpret them.

For example, I don’t just want to give you the “profit” made by the company. Because:

- It doesn’t make sense to isolate that figure. It’s a result. You need to understand where that result comes from,

- You also need to know where the manager’s remuneration comes in. If the manager is also the owner, this can modify profitability targets. We’ll look at that too,

- And above all, what do we mean by profit? If you’re a natural-born accountant, great. But if you’re not… what’s profit?

The remuneration of the tea store manager and owner

So how does a manager get paid? And the store owner?

Because it’s important to distinguish between the 2:

- The manager operates the premises daily. He works there, and his compensation is an expense.

- The owner owns the store, i.e. the stock, the brand, etc. He doesn’t work there. He therefore receives no remuneration, but dividends when the business is profitable.

In practice, most independent tea store managers are also the owners. In our example, the owner/manager has a monthly remuneration to which he could add dividends since the net result is positive.

Tea store sales

Ok, now we analyze the store’s figures. Starting with sales.

Where does the €190,000 in sales come from?

Here’s a realistic basis:

- 65% of sales come from tea (mainly loose tea in 100-gram bags or tins).

- 20% of sales are from coffee. If you’re surprised, stay tuned. I’ll post soon anarticle about this.

- 10% with accessories such as mugs, teapots, thermos… No surprise there.

- 5% with complementary products. It’s a bit of a catch-all category, I grant you. It often concerns oils, chocolate, incense, etc

Note that the more your store tends towards the delicatessen, the larger the share of your turnover for these complementary items will be.

If you’d like to know more about how to generate this turnover, I’ve got an article explaining how 1,000 loyal customers are enough to run a tea store.

Tea store expenses

Your store’s purchasing costs

Starting from our sales, we deduct purchases:

- 44k€ of tea purchases (including labels and packaging). Here I multiplied their cost by 2.8 to get the selling price. If you want to know more about the margins made by an independent tea store, it happens here.

- 20k€ of coffee purchases (including labels and packaging). Here, you multiply by 2. It’s not as good as tea, but coffee has other advantages you should consider.

- 9k to buy accessories. In general, you won’t do better than “factor 2” on these items. Example: a teapot sold at 29.90€ (including VAT this time) in your store will be bought at 12.50€ supplier price (excluding VAT).

5k€ purchase of complementary products. This depends on what you’re selling, of course. But these will rarely be high-margin products. In our example, we’re doing x1.9.

Remuneration of the tea store manager and salaries

To run, the store needs staff.

But we’re lucky here because the manager works full-time. So he only needs one additional employee – also full-time.

How much does the store employee earn?

In our case, the employee earns €1,900 gross / month. In France for example, that’s a net salary of around €1,500.

But what is the total salary cost to the company? It depends of the country where you operate.

In France:

Gross salary + employer charges = “super gross salary“

= all charges borne by the employer

2,100€ of super gross salary over 12 months makes 24,600€ of charges for the company over a year.

How much does the store manager earn?

Our manager earns €34,700 a year before deducting contributions and other levies.

Monthly, his compensation will be 2,900€ before deducting any contributions.

This gives him a net remuneration of around 24,100€ net/year in France,

or about 2,000€ net/month.

Amortization

Here’s an accounting concept that makes your head hurt. Yet it’s not complicated, you just have to explain it well.

So I’ll give it a try. What is amortization in accounting?

Amortization is the spreading of certain past expenses over several accounting years.

For legal reasons, you can’t count these expenses over a single year. Instead, you spread the costs over several years.

This generally concerns goods that will remain inside the company for a long time, and whose purchase cost is significant.

Example: fitting-out work and the purchase of furniture for the store.

Here, €30,000 was spent on it. In accounting terms, 2 things happen:

- You pay for the work and furniture which impacts your cash flow. You have -30,000€ in your bank account,

- But, in your income statement, you don’t record -30,000€ in the first year. We’ll look at how many years you need to amortize (smooth out) these costs. Let’s say 10 years in this case. Okay, so you record €3,000 of amortization in your yearly income statement for 10 years.

Why do we do this?

Because these assets are intended to remain in the company for the long term. They’re not like a service you consume.

In 10 years, your furniture is supposed to be there still. So we spread the cost over time, even if you paid for it in one go. All good?

Interests and debt servicing

In our example, I’ve assumed that our owner/manager borrowed €40,000 from his banker, and repaid over 7 years at a rate of 3% – yeah he negotiated well ;-).

What was the loan used for?

- To build up initial stock,

- To pay for the furniture purchased when the business opened, etc.

But why are only 628€ of loan repayments shown in the table?

Simply put, only the interest and insurance costs associated with the loan are recorded in the income statement. Repayment of the principal takes place on the balance sheet. But that’s another story.

The interest paid is therefore a type of expenditure. Our owner, having borrowed €40,000, will have to repay a total of €44,396 over 7 years.

The extra 4,396€ represents 628€ / year. To calculate the total cost of a loan, I recommend this site.

Interests and debt servicing

In our example, I’ve assumed that our owner/manager borrowed €40,000 from his banker, and repaid over 7 years at a rate of 3% – yeah he negotiated well ;-).

What was the loan used for?

- To build up initial stock,

- To pay for the furniture purchased when the business opened, etc.

But why are only 628€ of loan repayments shown in the table?

Simply put, only the interest and insurance costs associated with the loan are recorded in the income statement. Repayment of the principal takes place on the balance sheet. But that’s another story.

The interest paid is therefore a type of expenditure. Our owner, having borrowed €40,000, will have to repay a total of €44,396 over 7 years.

The extra 4,396€ represents 628€ / year. To calculate the total cost of a loan, I recommend this site.

We haven’t forgotten any charges here?

That’s right, I haven’t counted every conceivable expense in this article.

This is for 2 reasons:

- I want to simplify and show the essentials. For example, I haven’t included stock variation because it’s more of an accounting treatment and would make our discussion unnecessarily complex,

- I don’t know your situation. Our store example remains a case study, not an absolute truth for your tea business.

Conclusion

In our example, your tea shop :

- Generates sales of €190,000 before tax,

- Pays a self-employed manager 34,700€ / year. The net will depend on the country you operate of course,

- Is profitable, generating a net income of around 8,570€, which could be used to pay dividends to the store owner.

As for the €190,000 sales figure and how to reach that figure, I recommend our article 1,000 loyal customers are enough to keep a tea store going. Have a good read…